MD of Blue Semper Consulting Sudesh Pursad

ESG is fast being accepted as a necessity metric for business longevity, providing a solid platform to create stakeholder value and ensure sustainable growth.

ESG Global recently sent Dr Sudesh Pursad, MD at Blue Semper Consulting, three clever questions on his DBA research into Evaluation of the Strategic Impact of ESG Investments on Financial and Non-financial Value Creation in South African Corporates.

What were the most unexpected findings, for you, from the research conducted into the strategic impact of ESG investments?

Surprisingly, 89% of large South African companies have integrated ESG into their business strategies, driven by compliance, business resilience and risk management, and investor requirements rather than solely ESG objectives. Unlike developed markets focused on environmental factors, South African corporates emphasise strengthening social and governance impact to address socio-economic challenges.

Apart from mandatory ESG disclosures for listed companies and investor disclosure demands for large corporates, the ESG accelerators were events like loadshedding and COVID-19. Corporates needed energy security and, as a business resilience and risk management strategy, installed solar panels to ensure business continuity. Similarly, during COVID-19, some companies opted to screen and test entire communities from which their staff came, again to protect productivity. These practices were positioned as ESG initiatives but were simply a business continuity initiative.

This led to a new term being coined in my research of ESG-Usual, highlighting how business-as-usual activities also fulfil ESG goals.

Unexpectedly, non-financial outcomes are gaining importance, viewed as vital for long-term sustainability and strategic advantage, despite their current lack of quantification. This reflects an emerging paradigm shift that, while financial ROI remains critical, there’s growing recognition of ESG’s intangible value, challenging the traditional compliance-driven perspective in the South African context.

In summary, the most unexpected impact is that ESG is evolving from compliance to strategy (ESG-Usual to ESG-Strategic), where non-financial impact becomes a catalyst for resilience, innovation, and long-term value.

With scorecards, SDGs and a number of other benchmarks in place for sustainability, where should businesses start in navigating ESG complexity?

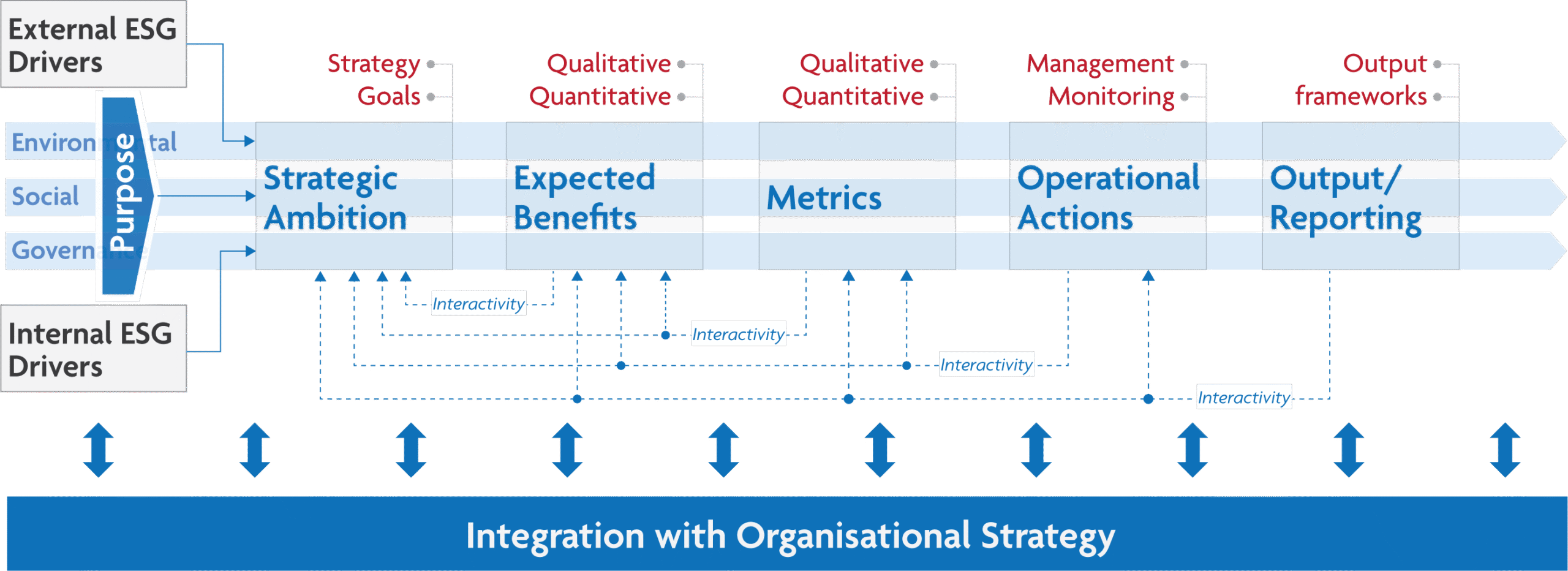

ESG is not as complex as some gurus position it. It is simple to address if executed in a structured manner, for example, by using the Interactive ESG Ecosystem Framework that was developed in my doctoral studies.

Simply stated, start with purpose, prioritise what matters, embed ESG into strategy, and let simplicity drive scalable, sustainable business value, stakeholder trust, and competitive advantage.

The simplicity begins with clearly defining the “Why” with a clear purpose. This reduces noise from scorecards, ratings, or SDGs by prioritising what’s relevant.

Build an ESG value-driven roadmap, and not a checklist, as it is not a compliance exercise. Even the most basic start with a small stakeholder group, a handful of SDGs and metrics, monitored on a spreadsheet by conscientious resources, and reported transparently and honestly, will generate massive trust and serve as a strong foundation for the organic evolution of ESG management and maturity.

ESG activities (if designed well/simply) are flexible and adaptive to align with changing business needs. They can be reported against the recognised standards (e.g. Sustainable Development Goals), and a globally recognised but fit-for-purpose framework (e.g., GRI, SASB) that aligns with your business and stakeholder needs.

Lastly, integrate and do not isolate. The critical success factor of ESG permeation is executive and senior management-led initiatives in the organisation. Embed ESG into strategy, risk management, capital allocation, and performance reviews — not as a separate “sustainability department” but part of how the business runs.

How are the executive research participants from large South African corporates, who participated in your study, navigating the nexus of building ethical, sustainable and profitable businesses?

The short answer is that this is a challenge! They must juggle “day jobs” (for non-dedicated resources), limited financial resources, multiple reporting frameworks, investor and rating agency demands, scarce automated data for reporting, and the challenge of embedding an ESG culture within their organisations. Despite these challenges, they have managed to embed a level of ESG maturity.

South African executives are navigating ESG by embedding purpose, prioritising non-financial returns, adapting to local realities, and treating ethical and sustainable business practices as strategic levers for profitability, resilience, value creation, and long-term growth.

In addition to being purpose-driven and executive-led, they are starting to view ESG as strategic, rather than as a cost centre or regulatory burden, and are strategically unlocking value through improved risk management, innovation, stakeholder trust, and investor attractiveness. They are also beginning to acknowledge and leverage ESG as a long-term value creation tool, especially through non-financial ROI such as increased stakeholder trust, reputation, employee engagement, and societal goodwill, which lead to enhanced long-term financial performance.

One executive shared, “We track culture, trust, and inclusion as leading indicators of future profit.” They also recognise that a strong organisational ESG culture starts by moving hearts and minds. This is a top-down imperative, with a strong tone at the top and active boards seen as crucial to embedding ESG into decision-making and organisational culture. Their most formidable challenge is balancing short-term pressures with long-term goals, which creates a tension between delivering financial results and investing in ESG. Still, many are working to shift mindsets across the business to value long-term, sustainable growth. Lastly, executives are slowing warming up to the concept of ESG-Usual to ESG-Strategic, where frameworks should enable and not constrain strategy.

Subscribe to ESG Global newsletter

Subscribe to ESG Global newsletter